SAN ANTONIO — Start off 2022 strong with our KENS 5 financial checklist. Plus, if you're setting new goals, we have tips to help you actually stick to them.

January can bring a renewed sense of motivation. If you want to make it the best year it can be, a local financial advisor shares how to start it off right.

First, look at your cash flow.

CASH FLOW

“If your job hasn’t changed and your income situation has not changed, you know what’s going to be coming in the door," said Karl Eggerss, principal and financial advisor, CAPTRUST. "What are some big major expenses you foresee, and plan for that in advance."

CHECK INVESTMENTS

Eggerss said now is the time to look over your investments and carve out what’s not performing well.

“In addition, you need to see if your asset allocation is correct. You may have started the year with 60% of your money in stocks, and 40% in bonds for example. If it’s gone out of whack – maybe 70% in stocks and 30% in bonds – you may have to do some rebalancing,” he said.

SIMPLIFY

Auto-pay is a simple tool to ensure your bills are paid on time and it increases your credit score. Eggerss added an extra tip: If you can, consolidate your accounts.

“Do you have numerous stocks and numerous mutual funds and numerous exchange traded funds? Is there a way to simplify that? Can you consolidate two IRAs into one? I think it’s a good time to look at your overall portfolio to simplify,” he said.

GET ORGANIZED

Get your documents in order is by having them stored in a central location or create a digital archive for easy access.

“Who are the key players in some of your financial documents? Does your next of kin know where you keep your will, for example? Do you have certain instructions written down just in case something were to happen to you?” asked Eggerss.

CHECK BENEFICIARIES

“The one that’s overlooked is checking beneficiaries. Look at your IRAs, look at your 401(k) at work. Who is the beneficiary?” asked Eggerss. “Maybe it’s an ex-spouse and maybe you don’t want it to be that ex-spouse. You need to change that.”

HOW DO I STICK TO MY GOALS?

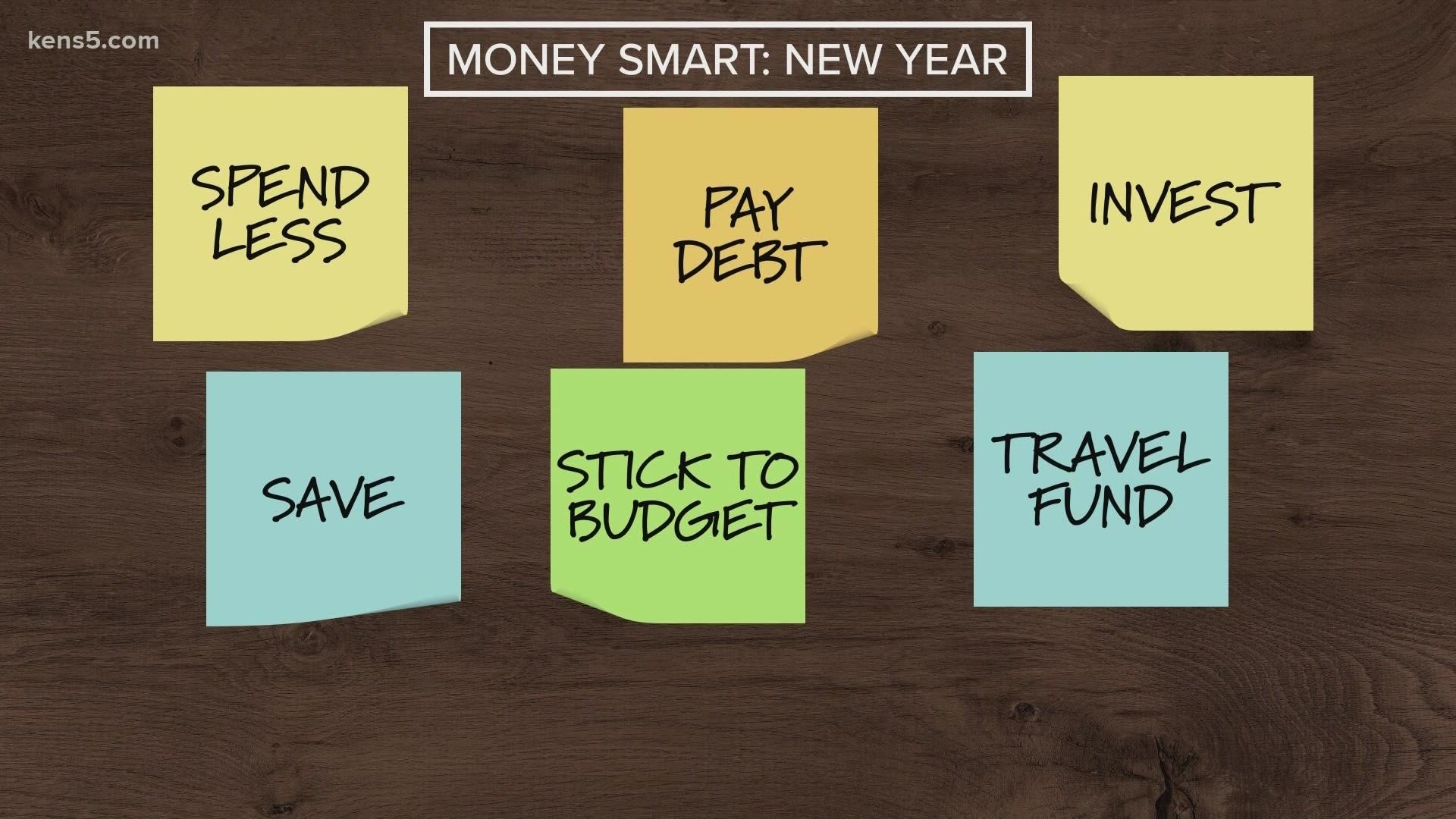

Once you've knocked out the financial checklist, it's time to set new financial goals for the year. According to a Fidelity New Year's resolution study, people want to save more money, pay down debt and spend less in 2022.

KENS 5 sought out advice from the Impact Authority's Stephanie Scheller. She's an entrepreneur, author and coach who has helped local businesses grow through various marketing strategies. She shares pointers that can help you along your goal-making process.

START SMALL

Scheller said it will take time and focus to hit your marks. She recommends starting small to avoid burnout.

“I tell people scale it back. Think about it for just one minute. Instead of going, I want to drink a gallon of water a day. You say, I want to start tracking how much water I drink every day. Because that’s really small and small changes are sustainable,” she said. “Time is not your most valuable resource. Money is not your most valuable resource. Energy is.”

THINK BIG PICTURE

“Where do you want to be three or 10 years down the road and then, take stock of where we are today. Where are the areas if we were to draw out a graph, a chart, you would be falling short of where you want to be in 10 years?” said Scheller. “Then get it narrowed down (to), 'OK so, financially, I want to be here.'"

SELF-CARE

Scheller recommends taking a well-rounded approach to your plan. For example, she plays the violin to decompress, which in turn has helped her work more effectively.

“The personal goals are just as important as, 'I want to be here financially, and pay off debt and get this far,'” she said. “I always tell people self-care starts with self because it’s a little bit selfish, and that’s actually a good thing.”