SAN ANTONIO — Bitcoin is gaining popularity and there are predictions that the cryptocurrency will go mainstream. Here’s a quick rundown of the reasons behind the rise and what it means for you.

Whether you’re a critic or supporter of Bitcoin, there’s no denying this cryptocurrency is gaining momentum. It is the leader among cryptocurrencies and continues to hit record highs. If you don’t know what Bitcoin is, you can think of it like online storage of your cash. It’s a currency that operates without banks or the government. There's a finite supply of Bitcoin, only 21 million exist, which also adds to its value.

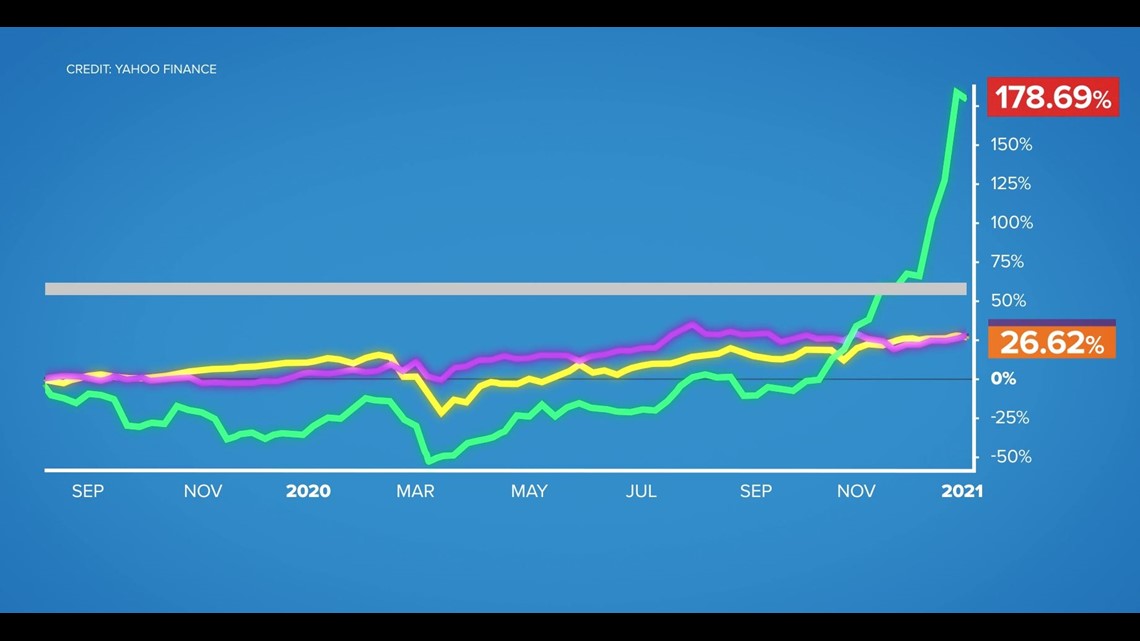

“At the end of the day, gold is a rock but we perceive it to have value and that's why people have added gold to their portfolios. Cryptocurrencies aren't really different, right?” said Karl Eggerss, senior wealth advisor and partner of Covenant. “If you look at Bitcoin versus gold or Bitcoin versus the stock market, you’ll see the problem with cryptocurrencies and why it scares a lot of people.”

This chart below shows how Bitcoin compared to gold and the stock market between September 2019 and now. The purple line represents gold, the orange represents the stock market and the green line represents Bitcoin. All three dropped during the COVID-19 shutdown in March. Bitcoin took the hardest hit. As the months progressed, the chart shows that gold and stocks went up about 26%. Bitcoin is now up 178%. There's volatility but high returns.

“It’s going to be extremely volatile moving forward and a lot of people can't handle that. It may make sense to be a diversifier for some people in their portfolios, a balanced portfolio. Most people may be putting one or two percent of their net worth in that and it's certainly not a recommendation. But it's a lot what I see currently,” explained Eggerss.

Eggerss said there a few reasons behind the rise. There are more institutional investors who are entering this digital arena and more companies that are adopting it.

“You have these legendary investors with a great track record and they're saying: we're buying Bitcoin. So, it causes the individual investor to say well maybe we should do the same,” said Eggerss. “I think for Bitcoin to be mainstream, it's going to have to be adopted by a lot of institutions. We've already seen companies like PayPal getting involved.”

Bottom line, what does it mean for you if you’re interested in investing in Bitcoin or investing more in this cryptocurrency?

"Dollar cost averaging is probably the best way to do that, whether people invest in mutual funds or stocks. You can do the same thing with cryptocurrencies," said Eggerss. “I would caution people to be very careful. Do your homework and probably put some money in there if you're going to do it -- that you can afford to lose."