SAN ANTONIO — Buy low, sell high—a classic strategy for successful investing. But it’s not always easy to execute. Here’s what you should do to avoid costly mistakes.

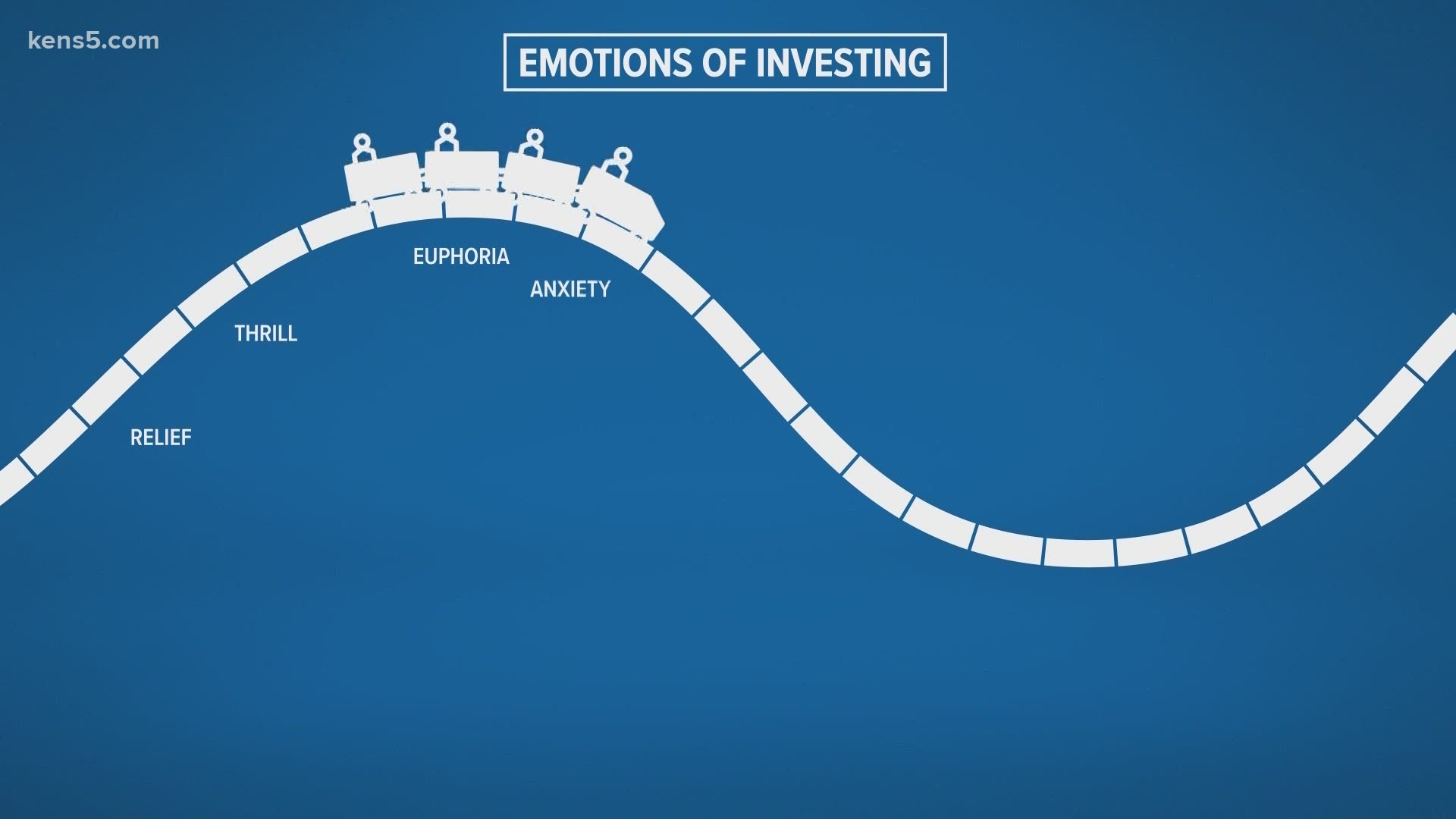

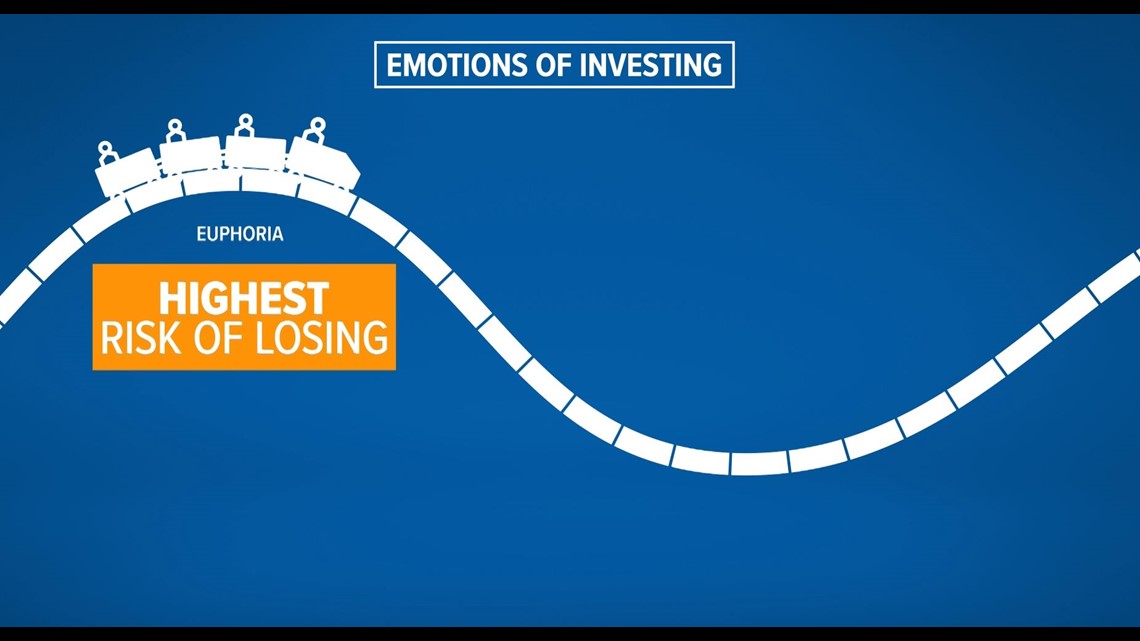

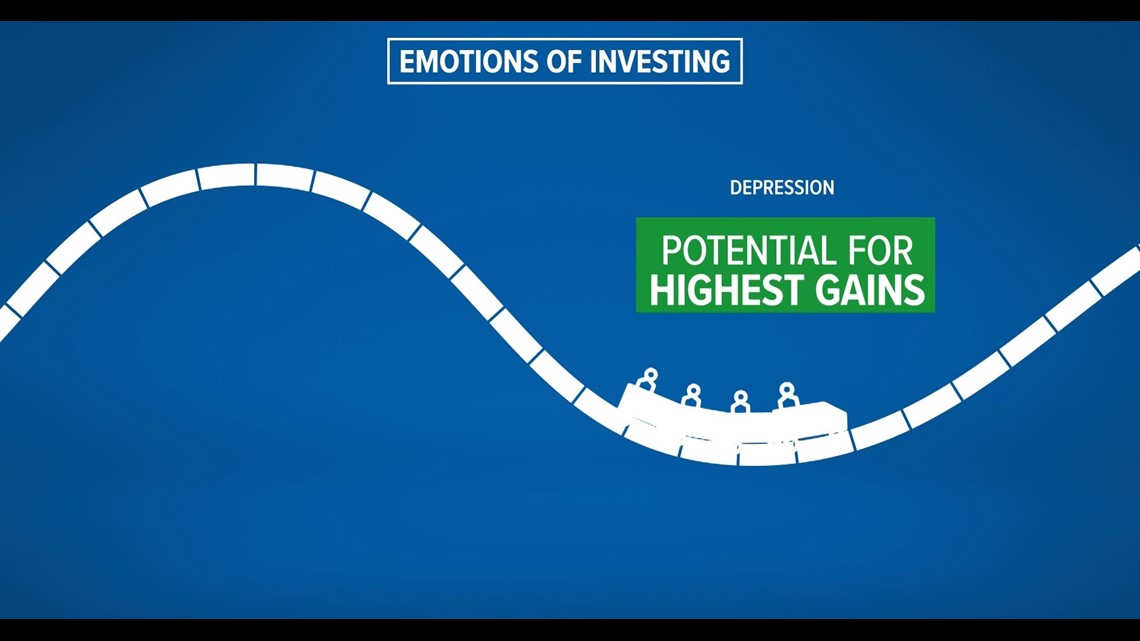

Emotions can influence our decisions on a daily basis but leave them out when it comes to investing. A natural reaction is to buy at the peak and to sell when there’s a dip. It seems counter-intuitive to go against those emotions, but it’s important to avoid the herd mentality.

“You think back when the stock market is down, people tend to be scared. That’s when people tend to want to sell, but if we can fight our emotions and we look back at history, and we have data on our side, it suggests that when there is fear, and the market’s down, that’s the time to buy in,” explained Karl Eggerss, senior wealth advisor and partner of Covenant. “Flip side, when there’s greed on the street and everybody agrees everything is great and it’s going to continue to go up, that’s usually the time that it’s a bad time to invest.”

One of the easiest ways to leave the emotion out of your investing process is to adopt a technique called dollar-cost averaging.

“The easiest thing to think about is your 401(k) at work. If you have a 401(k), every paycheck you put a little bit in. You’re not really thinking about it,” Eggerss said. “Over time, you’ll be buying at different prices and that has proven over history to really add to people’s wealth.”

Eggerss shared a few of the biggest investing mistakes.

“People see some kind of news event coming – namely an election, for example – and they say, 'I know, I know, the market is going to go down because of this particular outcome.' Number one, we don’t know the outcome. Number two, and more importantly, we don’t know the reaction of investors to that outcome,” he said.

Eggerss said another big mistake is when investors do not give themselves enough time.

“The get-rich-quick scheme. People invest in penny stocks, people invest too much in one particular asset, something new. They want to invest in the next best thing. The company that’s coming out with the new drug. Most of the wealthy people in this country have not done that,” Eggerss said. “There’s no free lunch in this industry. I’ve been doing this for well over 25 years. There is no free lunch. There is no magic bullet other than compounding, saving and time.”