SAN ANTONIO — Some analysts argue that the economy’s continued downward spiral is a sign that the U.S. is headed for a depression. KENS 5 takes a look at the factors that are driving this prediction and the opinion of one local financial advisor.

Thursday, the U.S. Department of Labor reported that about 3 million Americans filed jobless claims last week. The total number of people who filed for unemployment benefits is about 36 million.

Some economists argue that there are signs that the U.S. is headed for a depression which includes a historic unemployment rate, a projected negative GDP growth in the second quarter, and a massive decline in consumer spending. KENS 5 spoke with Karl Eggerss, senior wealth advisor and partner of Covenant, on the prediction.

“I think the depression word gets tossed around a lot and it’s a very big impactful word. It grabs headlines. I think we are having a severe recession. I think it will be a short recession but I think it will be pretty deep. A depression is a very different animal. When we go back to the Great Depression, we are talking about people sharing a piece of ham as a family together,” said Eggerss.

He pointed out that one of the biggest differences between the Great Depression and modern day is the shift in industries. Eggerss said eventually, the U.S. will be able to bounce back in growth.

“Back in the 1930’s during the Great Depression, we were a manufacturing economy. It’s very labor intensive. Now, we are a service economy. That’s a very big difference because of the fact that we can do things much, much quicker than we did before. Primarily, through technology. We are a service-based economy, which is the biggest thing we have going for us.”

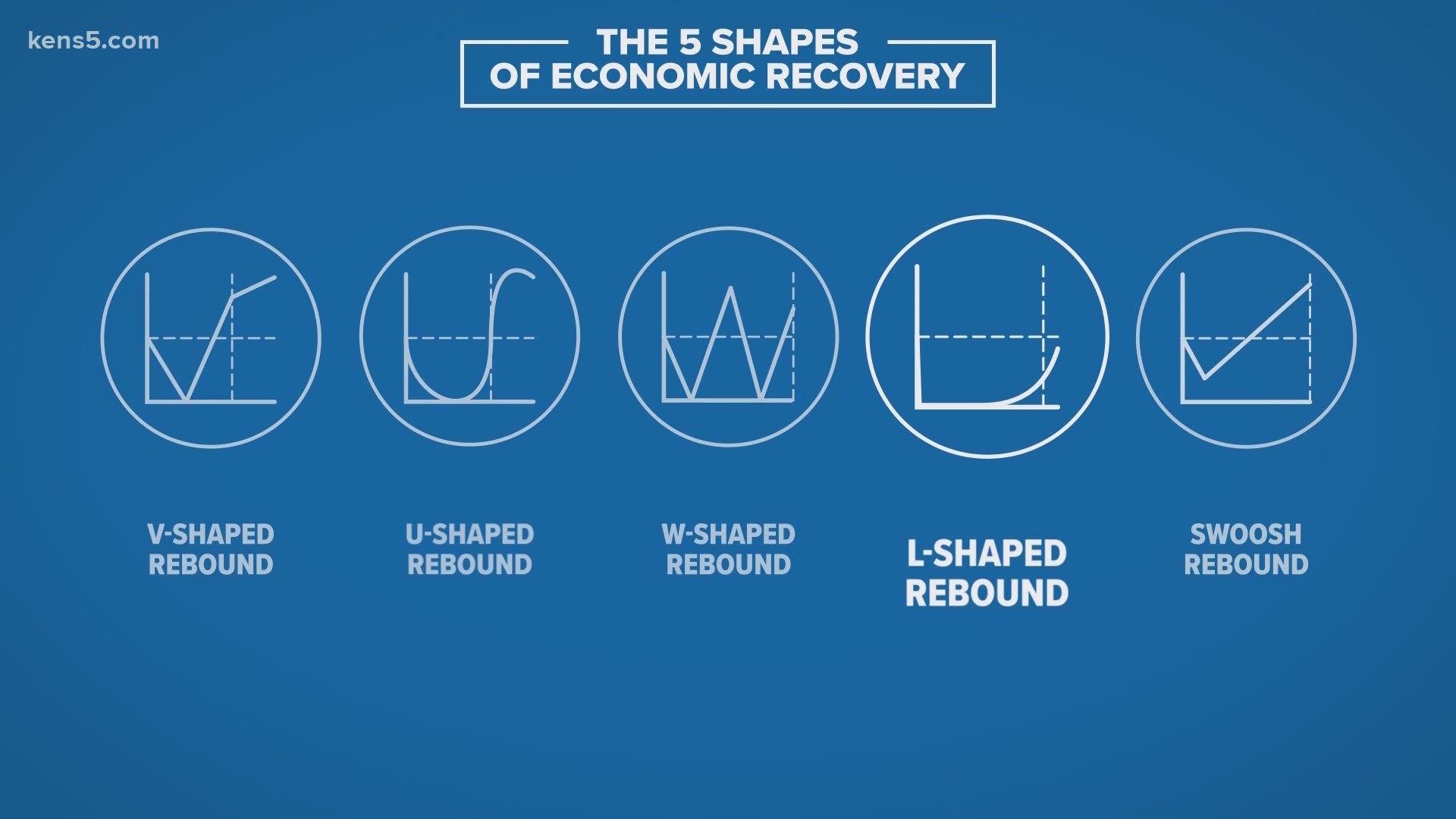

There are different shapes of economic recovery. Majority of economists have been projecting a U-shaped rebound, which is a downturn with a slow recovery. A depression is a L-shaped rebound, which is a sharp drop and the recovery flat lines.

Eggerss’ opinion is that the U.S. will have a swoosh rebound, which is a steep decline with a gradual recovery. He added that consumer confidence will play a key role.

“The consumer is two-thirds of the economy. How much the consumer, our viewers, how much they are actually spending, drives the economy and we know spending grinded to a halt in March and April. How quickly spending comes back, will dictate how fast the recovery is, whether it's a U or a swoosh,” he said.