SAN ANTONIO — New policy changes recently implemented by the Federal Reserve will impact all of us. But it will be especially harmful for people with a fixed income. Here’s a breakdown of the challenges ahead.

On August 27, the Federal Reserve announced a policy change at their annual Economic Symposium in Jackson Hole, Wyoming. Officials announced they will allow inflation to run above 2% for some time, in order to help the economy.

"The economy is always evolving, and the FOMC's strategy for achieving its goals must adapt to meet the new challenges that arise," said Federal Reserve Chair Jerome H. Powell. "Our revised statement reflects our appreciation for the benefits of a strong labor market, particularly for many in low- and moderate-income communities, and that a robust job market can be sustained without causing an unwelcome increase in inflation."

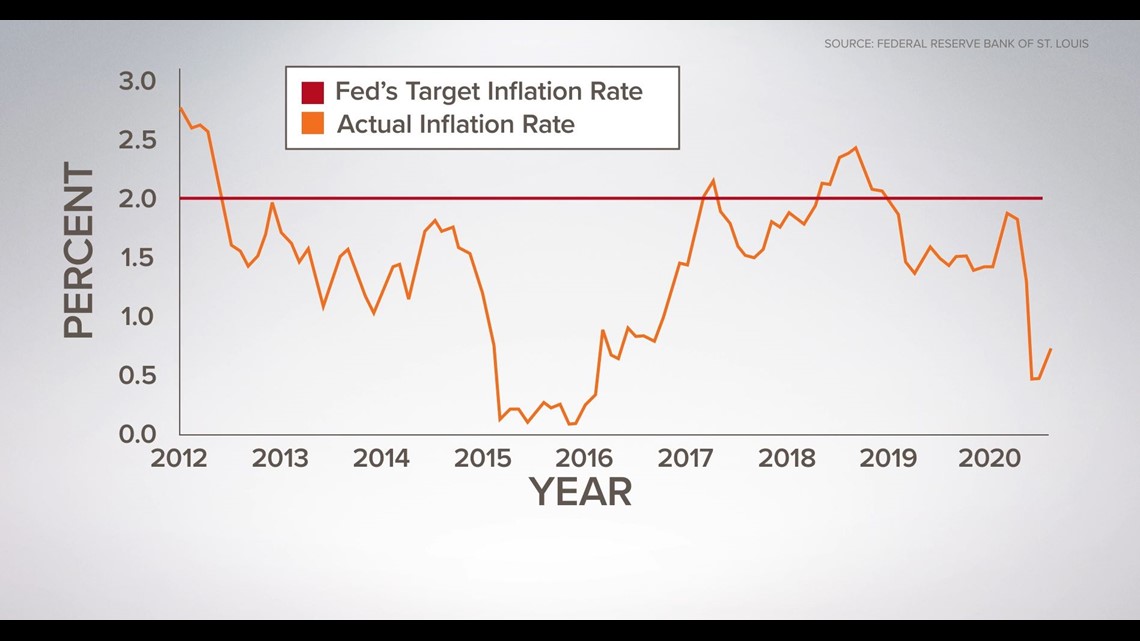

The central bank had previously set an inflation target of 2%. But in the last several years, the inflation rate has consistently undershot the goal.

“What that means for our viewers is that their costs are going to start rising over time for the next few years and, on the flip side, they’re probably going to keep interest rates lower for longer as well,” explained Karl Eggerss, senior wealth advisor and partner of Covenant.

While low interest rates will benefit borrowers, the Federal Reserve's decision will hurt retirees with a fixed income. Eggerss highly recommends people expand their sources of income. He said if you need money in the next three to six months, your cash needs to be in a money market or savings account.

If you don’t need to use money immediately, consider investing in stocks, bonds, annuities or real estate.

“Since the Great Recession, inflation has been higher than the amount that you could earn in a CD or at the bank. That gap has made people feel poorer, and poorer if they haven’t had a diversified portfolio,” Eggerss said. “If you’re retired, the first thing you have to do is prioritize what your expenses are. What you’re going to need to earn on your money to get you the lifestyle you want for the rest of your life. If it requires something higher than 1% a year? You’re going to have to diversify your portfolio.”