You’re told to save your money. But over time, your cash will lose value sitting in the bank and could end up hurting your retirement.

The majority of Americans don’t have enough savings in their bank to cover a $1,000 expense. While building an emergency fund is crucial, you shouldn’t solely be stashing your cash into a savings account or money market account.

“The wealthiest people in the world have made the quote: “Cash is trash.” What they mean by that is when you hold onto these dollars, it continues to buy you less and less goods and less and less stuff. Whether it’s gasoline or groceries. So again, you have to invest your money in things that are going to keep up or beat inflation,” explained Karl Eggerss, senior wealth advisor and partner of Covenant.

For people who are in retirement and living off their cash savings, they are faced with a bigger dilemma.

“People are forced to take risks that they may not know or they may not want to take. But that is what’s happening right now. It’s a real challenge for those who are on a fixed income and not able to save but living off of that income,” said Eggerss.

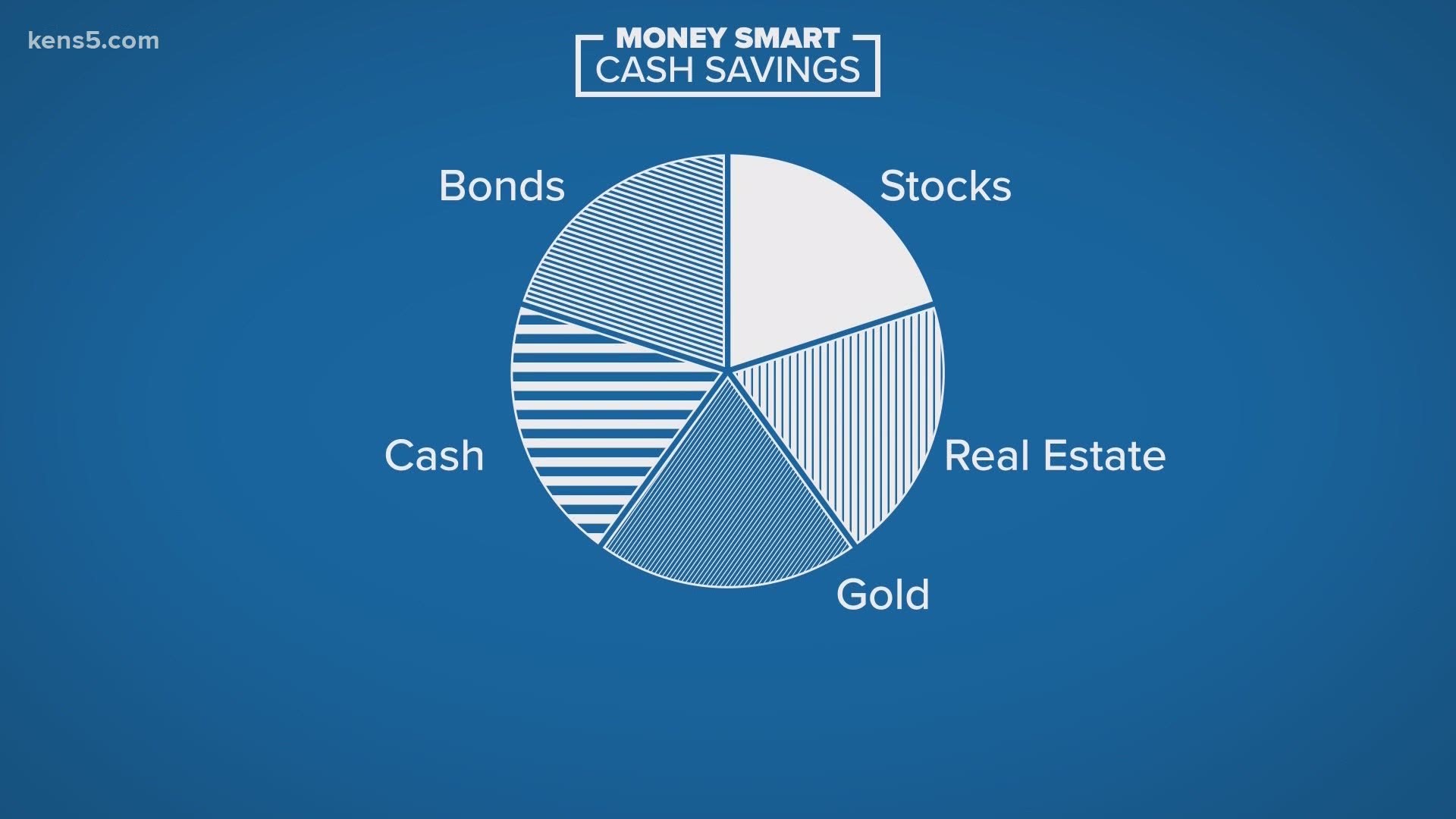

Eggerss said while people cannot stop inflation, people can take measures to protect their savings with different investments.

“You have to continue diversify and you do have to look at the stock market. It’s been a great return vehicle, especially for those that are not needing their money for the next 10, 15, 20 years,” he said. “Now, it doesn’t come without more risk. There is more risk investing in those. But it may not be as much as you think. I would say start your research and look at other investment options in terms of getting good income.