SAN ANTONIO — The pandemic not only triggered a recession but has deepened the divide for industries and economic classes.

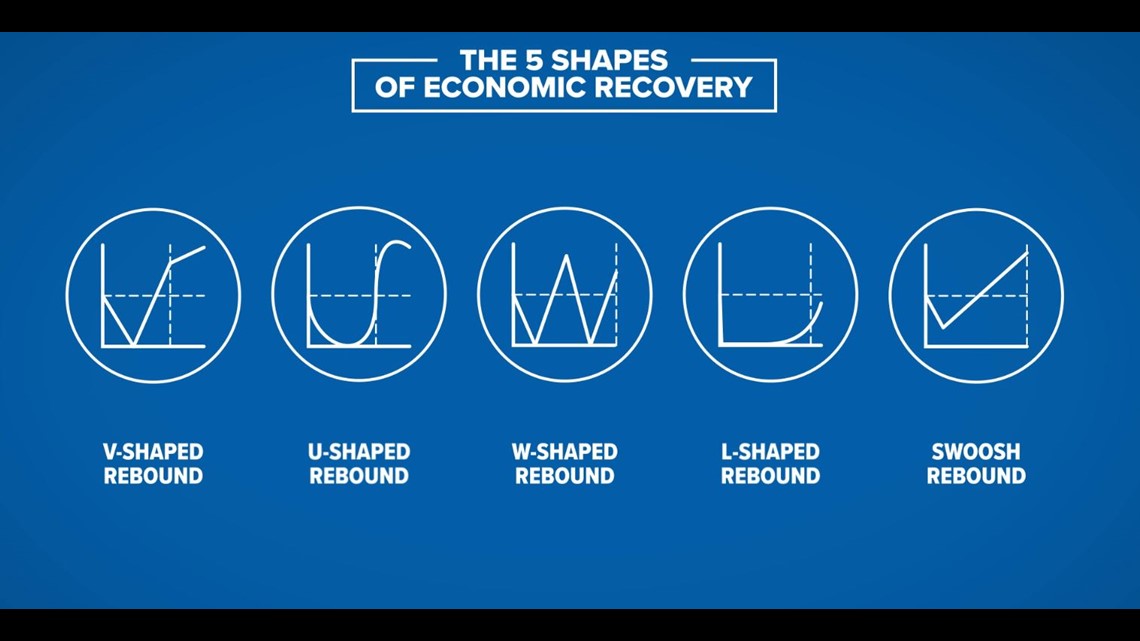

There are different shapes of economic recovery. A depression is an “L-shaped” rebound, which is a sharp drop and the recovery flat lines. Back in May, some economists argued that the U.S. was headed for an “L-shaped” rebound. They pointed to a historic unemployment rate, a projected negative GDP growth, and a massive decline in consumer spending.

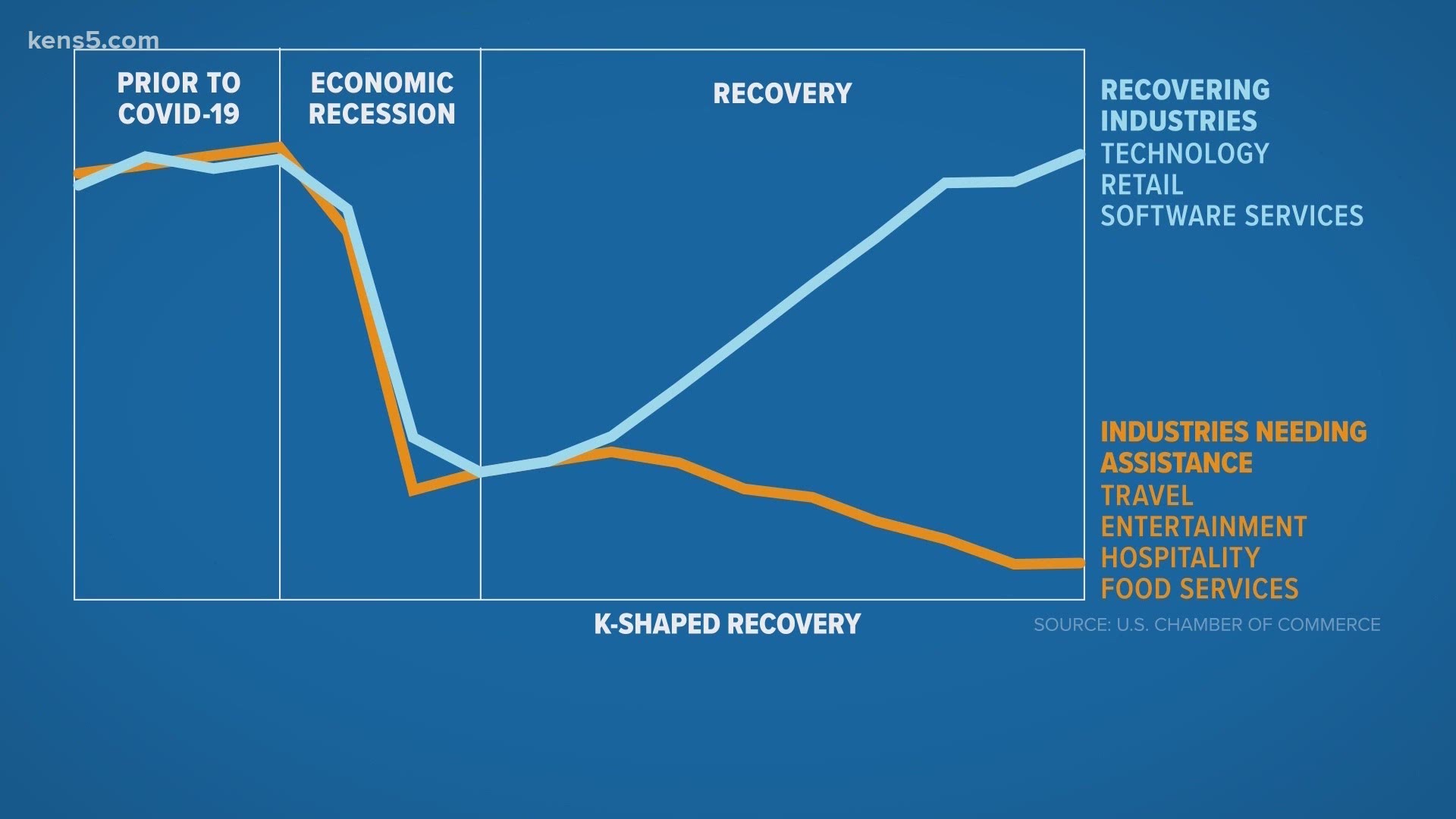

As shutdowns were lifted and businesses were able to reopen, some economists believe the U.S. will experience what’s called a “K-shaped” rebound.

“The ‘K’ refers to an economic recovery that is really bifurcated. You really have winners and you have losers. If you look at businesses with technology firms, video conferencing, hardware, software, they’ve actually done very, very well accelerating before COVID. They’re actually benefiting and recovering much, much faster,” said Karl Eggerss, a senior wealth advisor and partner of Covenant. “The other side that’s decelerating, which are things like cruise ships, the airlines, brick and mortar retailers, those are areas of the economy that are really struggling right now. Some of that was already in place.”

Eggers added that the divide is widened not only between industries but between the wealthy and poor.

“If you’re someone that has financial investments, real estate, or stocks, bonds, those have recovered quite nicely and are actually going up. For those that don’t have the means to save in the stock market, and maybe just have a bank account or savings account, they’re actually falling further behind because we have inflation,” said Eggerss. “I would encourage those people to take advantage of their 401k that has a match and really get invested in the stock market, because that’s where the long-term growth is going to be. You do want to be one of those beneficiaries.”