SAN ANTONIO — On the first Tuesday of every month, like-minded people gather outside the Bexar County Courthouse bidding for their next financial opportunity.

“For us, we find properties on the market that we can fix and resell and make a profit,” said Eddie Lozano, one of dozens of investors and realtors who attended April’s housing auction.

Lozano’s expertise in the real-estate industry goes back 10 years. He’s currently working on beautifying a house on the northwest side that once was owned by a church organization.

Lozano paid $186,000 for the home after placing the winning bid at April's auction.

“We got it more than we wanted to pay for, but it’s still a 2017 so it’s a good investment,” Lozano said.

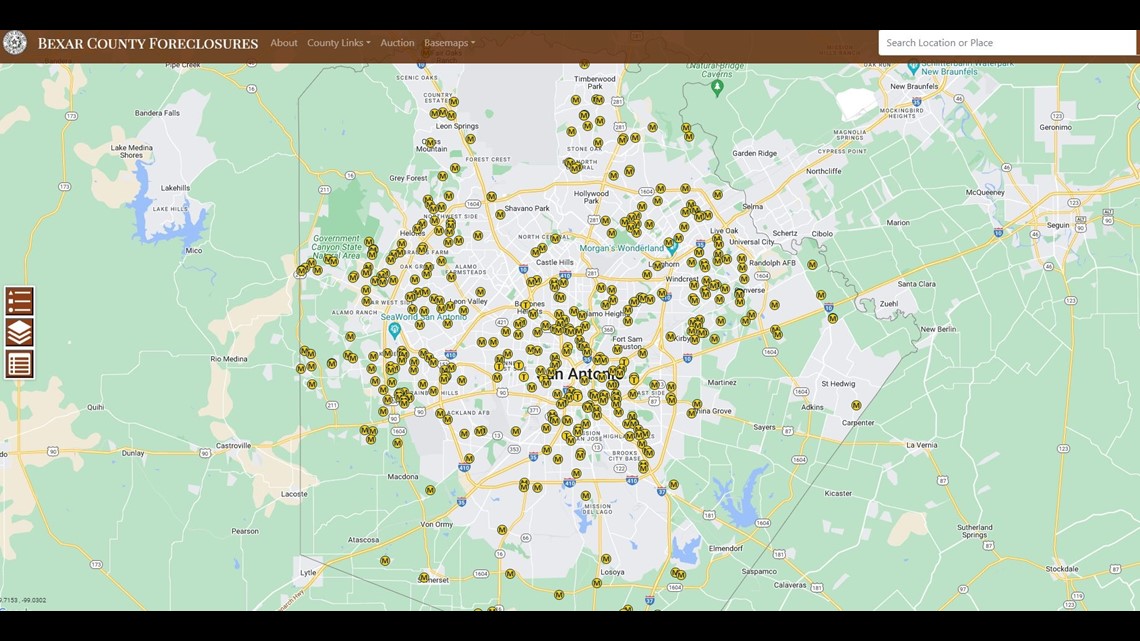

The Bexar County Clerk’s Office website provides a comprehensive list and interactive map showing hundreds of foreclosed homes—properties where the borrower has defaulted on their monthly mortgage payments.

Attorney William Clanton broke down how major life crises often leads to the complex process of foreclosure.

“95 or 96% of people who default on their mortgages or on credit cards or other financial obligations do so because of a death in the family, a loss of a job, an illness of a loved one, things like that,” Clanton said.

In Texas, foreclosures rose by 187.3%, going from a little more than 4,000 in the first six months of 2021 to about 11,500 foreclosures in the first half of 2022, according to property data group Attom.

The trend of buying and flipping foreclosed homes for profit continued during the changing housing market of the COVID-19 pandemic.

“I think a lot of the foreclosures, at least pre-pandemic, were home-flippers—people who are buying a home at a deep discount to renovate it, flip it, then sell it," Clanton said. "I don’t know if that’s just a good business practice these days with interest rates higher these days. The home market’s slowed down quite a bit."

As for Lozano, he’s hoping to make a sizeable profit in the coming months by selling the home he purchased a month ago once interior improvements are made. His hope is that the home he bought for $186,000 is able to sell for $260,000.

“We would need to put in new laminate flooring and then carpeting in the bedroom, paint job, maybe a fence and that’s it,” Lozano said.

He urges people on the verge of foreclosure or already in the process to arm themselves with knowledge and take action before they lose their home.

“If people would just call their realtor, whoever sold them the house, tell them, 'Hey, I’m falling behind on my bills,' a lot of the times the banks will work with you to do a forbearance until you get back on your feet,” Lozano said.

For those thinking about taking part in one of the monthly auctions, Lozano suggested having at least $200,000 to $300,000 you're prepared to part ways with. Only cash or certified funds are acceptable at the time of sale. Lozano stressed proper money management is vital.

>MORE LOCAL NEWS:

>TRENDING ON KENS 5 YOUTUBE: