SAN ANTONIO — Robert Stewart had no idea of the tax nightmare that awaited him after he bought a foreclosed home at a Bexar County property auction back in May 2021.

He bid $45,000 on the property, which had a much higher assessment value, and thought he was getting a good deal.

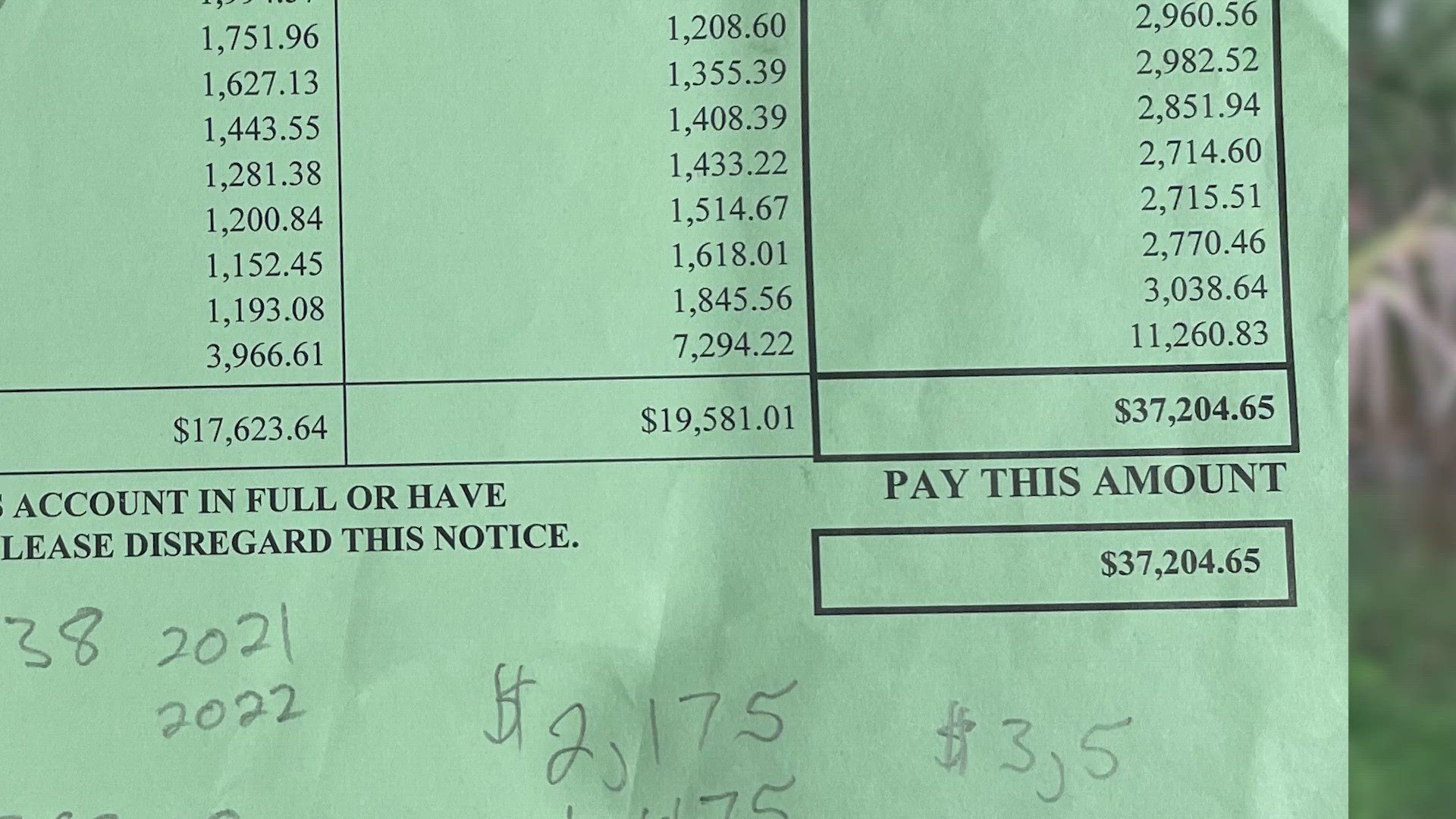

When Stewart got the tax bill, county documents put him on the hook for more than $35,000 of someone else's unpaid property taxes.

After Stewart called KENS 5, the taxes have been reduced, Stewart has a court date to fight the rest of the taxes, and Bexar County Tax Assessor Albert Uresti is making changes to keep this from happening again.

How, though, was it possible for Stewart to get stuck with thousands of dollars of someone else’s property taxes? He was, after all, buying a property that was being auctioned off for the purpose of recovering unpaid tax money.

It turns out, the county law firm that handles foreclosures didn’t include all the past due taxes in the lawsuit for the foreclosure.

Bexar County contracts with a law firm, Linebarger Goggan Blair and Sampson (LGBS), to collect some delinquent taxes on properties and handle foreclosures.

The property Stewart bid on and won at auction, which is located on Crystal Drive, was foreclosed by LGBS after LGBS filed a lawsuit for the delinquent taxes. An LGBS attorney told KENS 5 that the law firm originally filed a lawsuit for delinquent taxes due before 2009, and that lawsuit was completed in 2011.

However, for reasons LGBS could not explain to KENS 5, they did not actually foreclose the property in 2011. Instead, the law firm allowed a person to continue living on the property and to rack up more delinquent property taxes, until at least 2019.

LGBS kept track of the additional taxes that person owed between 2010 and 2018 but never finished filing their lawsuit for those unpaid taxes.

Finally, when Stewart bought the property in 2021, those past due taxes were charged to him instead. He didn’t find out until he got the tax bill for the next year.

“I was just in complete shock. I didn’t know what to say,” Stewart said. “How did I do this? How did I put myself in this situation?”

Stewart initially believed this was a mistake and asked LGBS to fix it but the law firm simply told him that he would have to pay. When he didn’t pay in 2024, LGBS filed a lawsuit against Stewart for those taxes.

The lawsuit never went before a judge and Stewart eventually called KENS 5 in Feb. 2024.

KENS 5 contacted the Bexar County Administration office, the Tax Assessor’s office, and LGBS about the issue.

While the county is the law firm’s client, County Spokesperson Monica Ramos just sent a response stating, “ Bexar County does not comment on pending litigation.”

The Bexar County Judge did not respond to KENS 5 at all.

When KENS 5 contacted the Bexar County Tax Assessor’s office, however, the tax office found out Stewart was being incorrectly charged for at least two years of taxes because no one lived at the property at that time. The tax office is now removing those incorrect taxes, which appear to total around $6,000, so Stewart will not need to pay them.

Additionally, while any person can look up the taxes associated with a property on Bexar County’s website, the foreclosure sale listings previously did not mention extra taxes attached to auctioned properties.

KENS 5 explained this issue to the tax assessor's office and now Assessor-Collector Albert Uresti is requiring the county law firm to include that information on foreclosure sales.

“When I found out about this problem, I contacted the law firm and told them, ‘We need to make this process more transparent,’” Uresti said. “From now on, when they do a posting, they are going to include all the taxes that are owed so that the buyer is aware of what is going on. They are also going to announce it at the tax sales.

Finally, Stewart now has a court date in April to fight the tax lawsuit. He believes the county law firm failed to follow the tax code with the previous owner.

Consumer Protection Attorney Bill Clanton told KENS 5 Stewart may have some good arguments against the county law firm if the county didn’t do everything they could to recover those taxes from the original owner.

“It looks like the county had the ability to foreclose this property in 2011 and then didn’t until around 2021. During those ten years, it could have prevented these taxes from accruing. Why should the county be able to collect those tax amounts from Mr. Stewart that it didn’t collect from whoever owned the property at the time?,” Clanton said. “That’s a failure to mitigate. The law says you cannot cause damages to increase by your own bad behavior or your failure to take action.”

While the county should now be disclosing additional taxes due on foreclosure sales, anyone looking to buy a foreclosed property should look up previous taxes on this county website.

KENS 5 will continue to follow this story.

If you have a problem like this, we want to help you fix it! In our series, Call KENS, we do our best to solve problems for our viewers. The number to call is 210-470-KENS, or fill out the form on this page.