SAN ANTONIO — If Dora Torrez could go back in time, she would never have signed a document for solar panels on her home.

The south San Antonio homeowner thought she was going to be saving money when she signed a contract with a solar panel salesman in April of of last year. Instead, she was stuck in a loan that she would likely never have repaid.

Torrez said the salesman did have a convincing pitch, even though he called over the phone.

"The payment was going to be $260. 'Less than my light bill,' is what they told me," Torrez said.

She said the man also claimed she would get a tax refund of up to $15,000 after completing the project. She eventually signed a contract by checking boxes on her phone.

“They were explaining how much of a rebate I was going to get or how I was going to save money. It sounded good,” Torrez said. “They kept telling me, if the electricity ever went out, it would be safer for him [my son].”

Little did Torrez know, she had actually just signed onto a roughly $59,000 loan with a company named Mosaic. She said the company started asking for payments immediately even though the solar panels weren't yet installed.

“I kept telling them. They haven’t even set it up,” Torrez said. “You are supposed to be saving me money! How is this saving me money?”

Contractors did come out to install the panels later last year, but CPS Energy told KENS 5 the contractors never got the solar installation approved with the city.

Torrez said she was still getting calls and emails asking her to make payments a year later despite the fact the solar panels still didn't meet CPS Energy standards and weren't providing electricity.

Finally, in February, Torrez called KENS 5.

Torrez was already concerned about the loan before KENS 5 went over the contract but additional details made her even more alarmed.

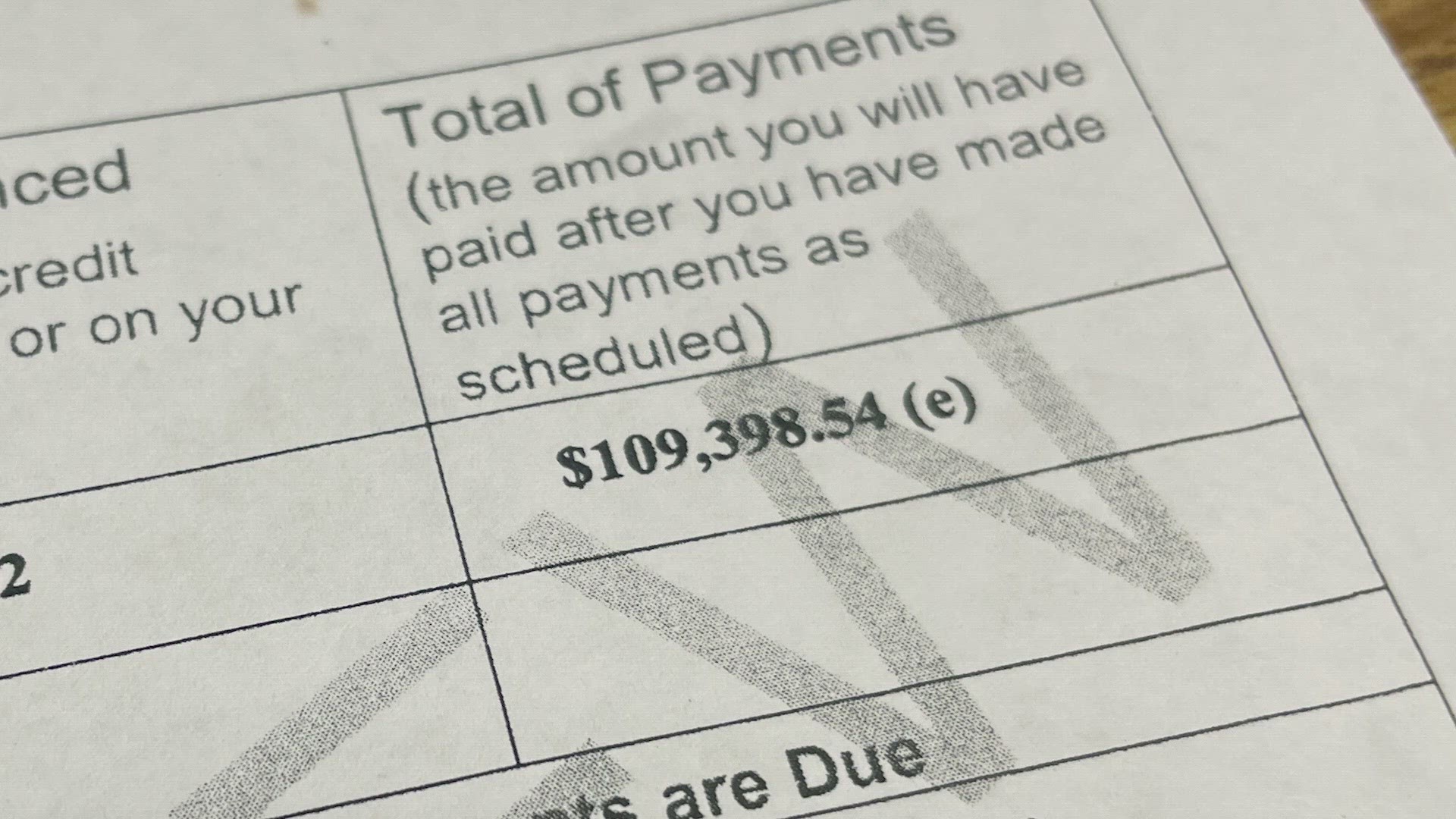

The loan itself was for around $59,000 but there was also an additional financing charge to pay.

That charge was nearly $50,000. This meant the total amount she would need to repay was more than $109,000 over a period of 25 years.

Torrez is 78-years-old and lives on social security payments.

"I'm too old! When is that ever going to get paid?" Torrez said.

Torrez also claimed the sales person had never shown her the Truth in Lending statements that accompanied the loan. Unfortunately, her digital signature was still on the next page of the contract.

KENS 5 then reached out to Consumer Protection Attorney, Bill Clanton, to find out if the contract was legal.

Clanton said the broad terms of the contract did not actually break any laws, though it could be challenged for other reasons. He also said the contract could allow Mosaic to place a financing statement against the home, which acts like a lien, and the company could even try to foreclose on the home of the loan isn't paid.

"They can sue you to foreclose that financing statement on your home so if things do go south there can be some pretty harsh consequences," Clanton said.

Regardless, KENS 5 reached out to Mosaic directly and asked if this 25-year-term loan for a 78-year-old person was written as intended. KENS 5 sent several emails and also contacted the company's Vice President of Marketing on their cell phone.

Then, a few days later, KENS 5 received an email from Mosaic, sent at nearly 10 p.m. CT, which stated: "This customer complaint you are referencing with Dora Torrez was resolved before your inquiry was received."

KENS 5 called Torrez the next day but Torrez said she hadn't heard anything from the company and said she had actually received another bill just ten days prior.

KENS 5 reached out to Mosaic again asking for clarification on what the resolution was.

Finally, in a second email, Mosaic stated, "I can confirm the resolution for this matter was a cancellation."

Torrez was no longer in debt to Mosaic. She also received an email from Mosaic later in the day which confirmed this.

"I'm very relieved. I'm very grateful that something can be done because I don't know what would have happened. I don't know what would have happened to the property either," Torrez said. "A load has been taken off by back. I couldn't sleep or anything worrying about how this thing was going to be resolved."

The email Mosaic sent Torrez, which confirmed the cancellation, said Mosaic chose to cancel the loan because they couldn't contact the solar contractor.

The email stated, "We have attempted to contact (the contractor) several times to confirm permission to operate your solar system, but did not receive a response. Due to their non-response we have sent them notification that we are proceeding with cancellation of your loan through Mosaic."

KENS 5 has not been able to contact that contractor either.

Torrez said she's just glad she is no longer is debt. She's also glad she called KENS 5.

"I've tried a lot of different things, contacted associations, and no one was able to help me," Torrez said. "I'm very grateful. Just speaking to you took care of it and they were able to resolve the situation."

If you have a problem like this, we want to help you fix it! In our series, Call KENS, we do our best to solve problems for our viewers. The number to call is 210-470-KENS, or fill out the form on this page.