SAN ANTONIO — Lt. Governor Dan Patrick wants to prove the Senate's property tax relief plan is better than the plan put forward by Governor Abbott in a public debate.

It's just the latest move in a nearly nine day battle within the Texas Republican party that quickly escalated from the legislature to Twitter with republicans openly disagreeing on how to reduce property taxes.

The special session didn't get off to a great start one week ago when Patrick said at a press conference the House republicans brought up Senate Bills two late and lost control of the chamber to democrats.

"Because of points of order and chubbing democrats have total control of the house chamber. Total control!" Patrick said.

The House of Representatives responded by quickly passing two bills, one of which was a property tax reduction plan, and immediately adjourning and going home for the rest of the session. Abbott then sent out a statement supporting the House's property tax reduction plan and claiming it was the only bill that fit the parameters set by the session.

Patrick responded that the governor does not have the authority to dictate how the legislatures writes bills but can only set priorities.

After the house adjourned, the Senate is technically stuck either passing the bills the house sent them or simply adjourning as well to end the first special session.

Patrick held a press conference today where he refused to do either.

"I'm not here to start or continue a fight with the Governor or the speaker. Why I am here is to fight for 5.7 Million average homeowners who, under the governor and house plan, get less than the senate plan," Patrick said.

Patrick then went to on to list multiple news articles outlining how Texas homeowners would benefit more than the senate plan. Articles have shown the senate plan, backed by Patrick, would provide more tax relief to homeowners than the house plan.

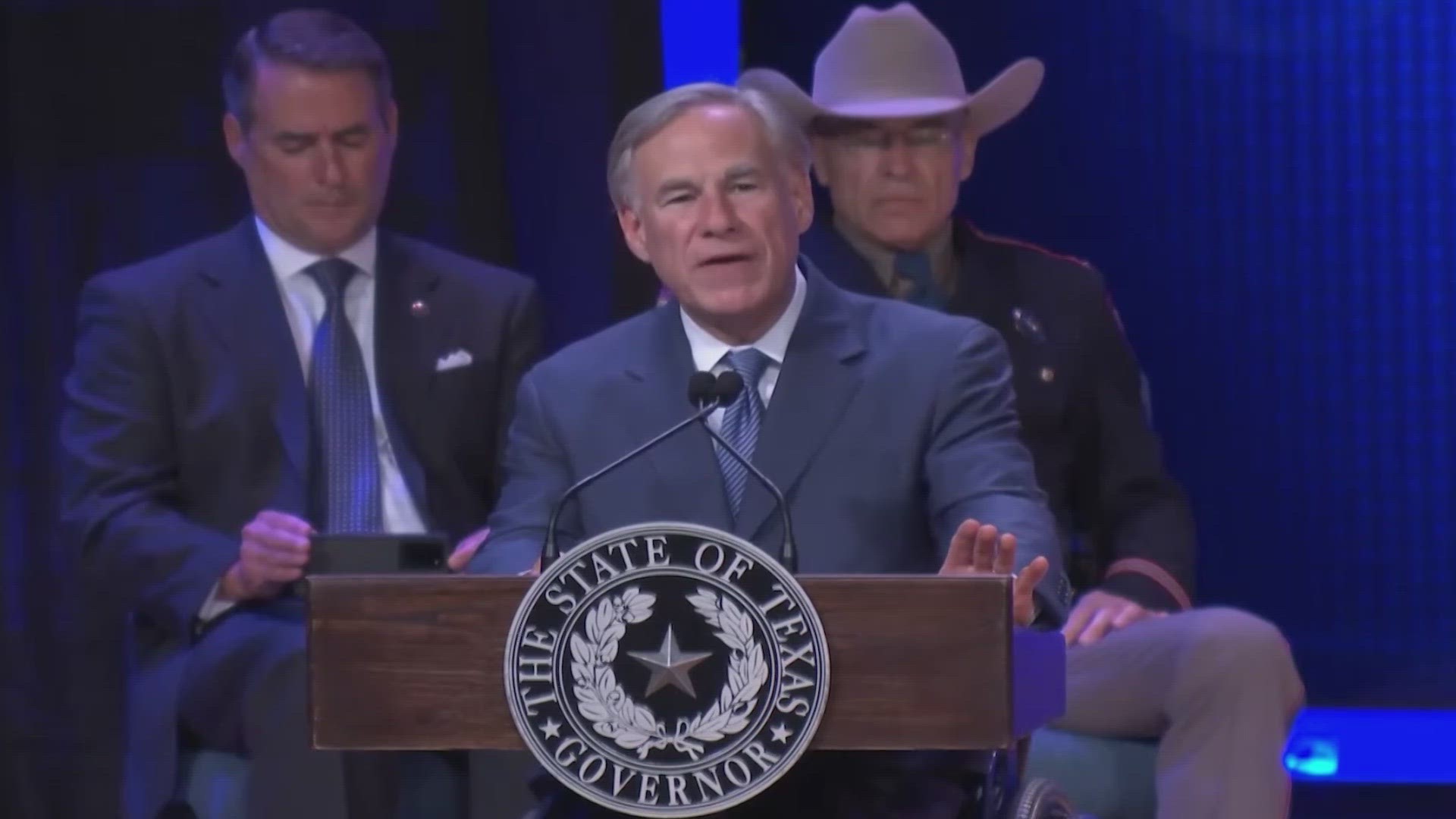

Meanwhile Governor Greg Abbott is now claiming the house plan would put Texas on a path to eventually eliminating property taxes entirely.

"What we want to achieve in the state of Texas is to eliminate your property Taxes. Make them go away," Abbott said Friday.

Armed with sheets of data and handouts, Patrick told reporters Tuesday that the governor's plan to end property taxes was "a fantasy", though he also said he believed the governor was being given incorrect information while touting that plan.

"If we eliminated property taxes in the next two years we would spend every dollar in our budget. There would be no funding for public education, no funding for healthcare, no funding for law enforcement," Patrick said. "If you have no money from property taxes, you have no money left to do anything. This is a joke! (It's) perpetuated by someone who is not the governor. Someone reeled him into this and he just said it."

Patrick said the only way to eliminate property Tax would be to increase sales tax from 8.25 percent to 20 percent. It's a move UTSA Political Science Chairman Jon Taylor said would burden lower-income Texans more than anyone else.

Patrick wasn't a fan of that option either.

"That's not going anywhere in the legislature and the people will never approve it. So lets just stop this that we are going to end property taxes. It's a fantasy," Patrick said.

The Texas Public Policy Foundation has put forward a plan claiming to eliminate school maintenance and operations property taxes over 12 years but it would not eliminate all property taxes.

At the same time, Patrick is still calling for the Texas House of Representatives to return and claimed they were "not that far apart."

Patrick said both plans would use $17.6 billion to reduce property taxes and both plans would use the money to reimburse school districts for lost revenue after reducing property tax rates.

The House plan would use all the money to reduce the school property tax rate that applies to both homes and businesses. The Senate plan would use 70 percent of the money to reduce the same tax rate, but would use the other 30 to specifically give homeowners a homestead exemption of $100,000 instead of 40,000. This means, if a persons home was worth $200,000 they would not pay any taxes on the first $100,000. The addition of a homestead exemption increase provides better savings to homeowners than the house plan, but less of a savings to businesses who are also affected by the lowered property tax rate.

Patrick said he is willing to debate the whole issue with Governor Abbott.

"We want 30 percent to go to give homeowners that deserve it the most an extra tax cut. What are we arguing about?" Patrick said. "If the governor disagrees with me, I invite Governor Abbott to a Lincoln–Douglas style debate on this issue of eliminating property taxes in the long term."

While Patrick told reporters the Texas House of Representatives could return to work without an issue, UTSA Political Science Chairman Jon Taylor said house had ended their first special session "sine die" and can't reconvene until a second special session.

Patrick said if House speaker Dade Phelan asked him to adjourn the Senate, so they could start a second special session, he would do it.

Taylor said Patrick is likely "posturing" but deciding not to end the Senate session today as it gives home more time to make his case before attempting to compromise once again.