SAN ANTONIO, Texas — Property tax sticker shock: Many homeowners are seeing a big increase in their property tax appraisals this year as property values skyrocketed. That bill may not be accurate, and you have the right to challenge it by Monday, May 16.

There was a 23 percent jump in taxable property values this year. The average market value for Bexar County homes is $309,000.

Review your property tax bill and ask this:

"Does that represent an estimate of value-added as of January 1?" said Michael Amezquita, the chief tax appraiser for Bexar County.

A quick way to check is to find out the selling price for homes in your neighborhood similar to yours.

Yet, do not assume that the appraisal sent from the Bexar County appraisal district is accurate.

“We do a broad brush mass appraisal approach,” Amezquita said. “We look at the sales in a given neighborhood. We don’t look at the actual particulars of your property.”

You can appeal your property tax bill if your market value increased by $1,000 or more in the last year. You will need to fill out a Notice of Protest by May 16 which can be done by:

- Mail: Bexar Central Appraisal District, PO Box 830248, San Antonio, TX, 78283. Postmark by midnight 5/16.

- Email: protest@bcad.org

- Dropbox at the Bexar County Appraisal District: It is located in front of the building at 411 N. Frio, San Antonio, TX, 78283. Note the gate to the building locks at 5 p.m. nightly.

- Online

“Last year we had a record number: 141,000 appeals,” Amezquita said. “We expect 150,000 to 160,000 this year.”

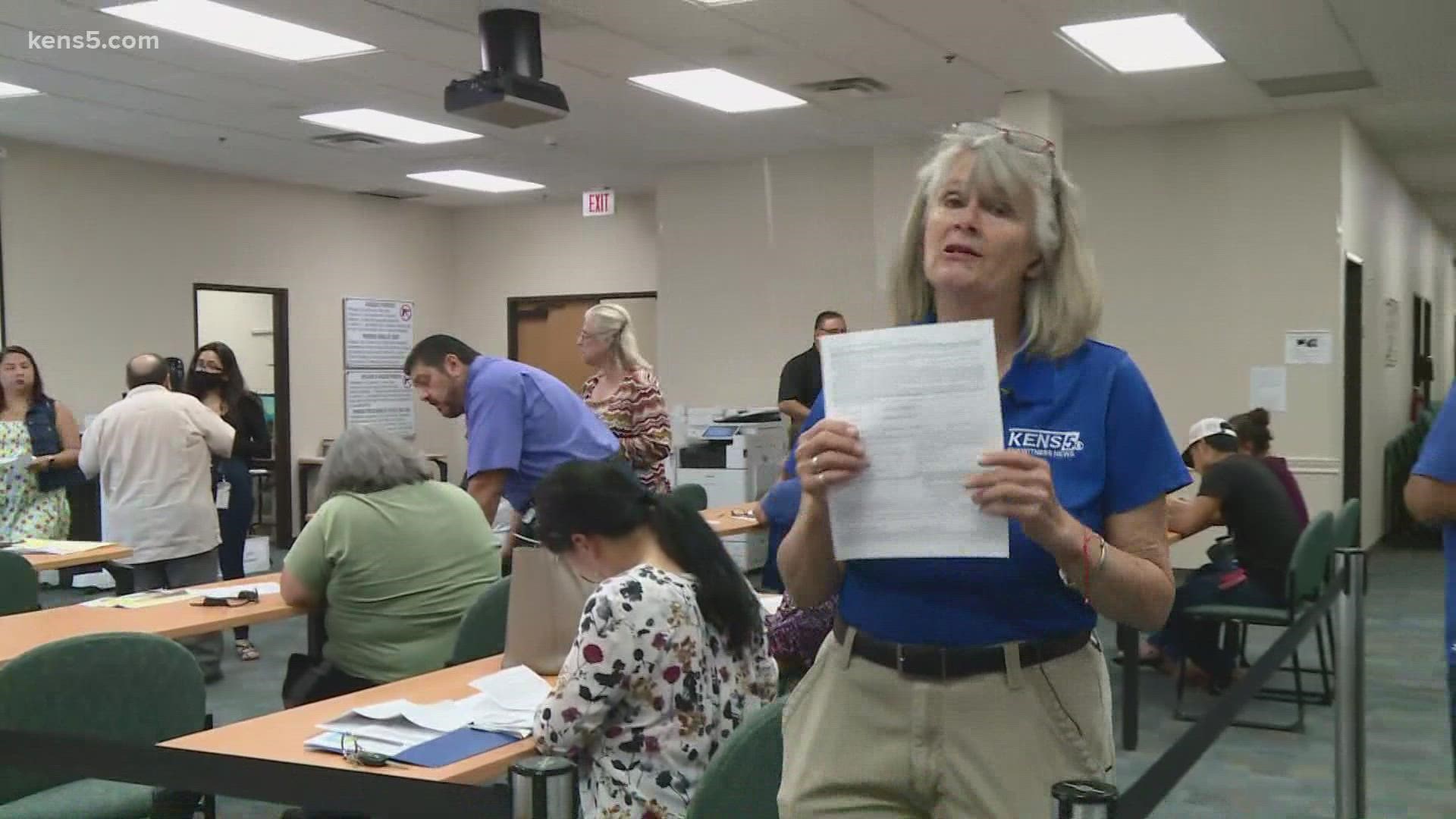

KENS 5 talked with property owners filing protests Monday at the Bexar County Appraisal District office.

"I would fight every single year!" said Mary Samano, one of those property owners. "Even if they deduct $50, it's $50 more you don't pay in taxes."

Donna Balin said she's concerned about the tax levels in Bexar County.

"I'm a native Texan and I'm looking at these appraisals and I'm thinking we're going to be taxed out of existence," she said.

Even after the appraisal office closes Monday evening, you still can send the protest form to protest@bcad.org. The deadline is Monday night at midnight.

"Print the form. The most important thing is that we have your protest by the end of the day," said Rogelio Sandoval with the Bexar County Appraisal District. "Once we receive it, we can answer any of your questions."

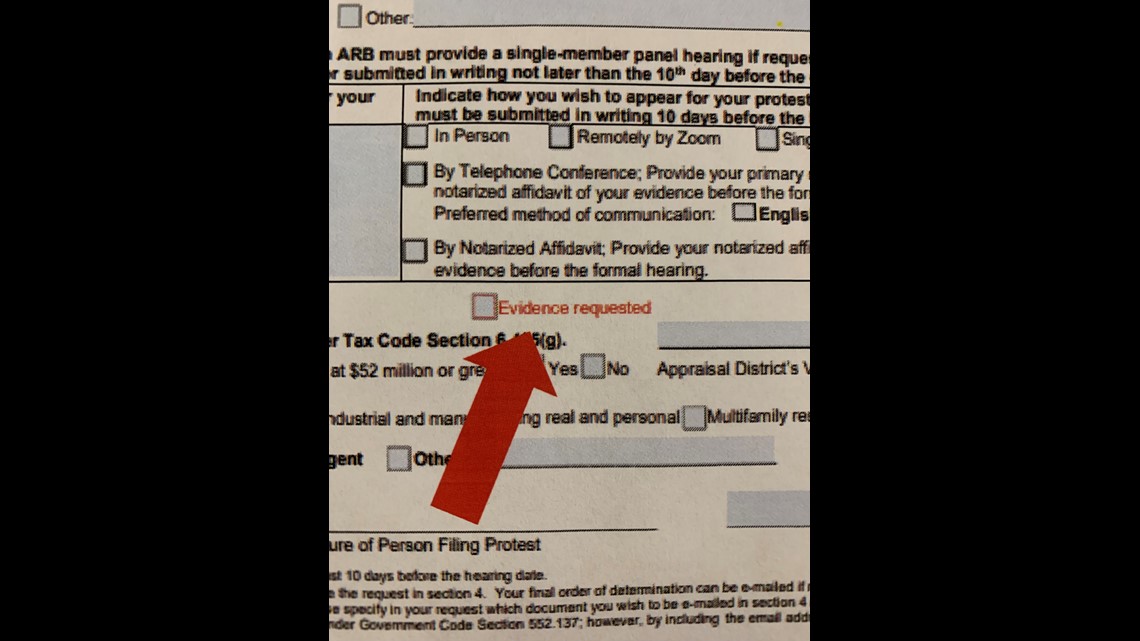

When you do file, be sure to check the red box for “Evidence Requested” on your notice of protest.

“We keep telling people to check that box. That box entitles you as a property owner to all of my evidence,” Amezquita said.

That allows you to be able to see how the tax appraiser came up with your property value. You will also pick a date for an informal hearing by Zoom, phone, email, or through the online portal.

Submit your own evidence about why your bill should be lower before the hearing. Documentation can include pictures.

“Pictures are worth a thousand words,” Amezquita said.

You can also submit a comparative market analysis from your realtor or estimates to repair any damage.

Do not mention this:

“If you’ve added a pool and I don’t know about it, please don’t tell me,” Amezquita said. “If you remodeled and I don’t know about it, please don’t tell me. That is not going to help your case.”

Almost 95 percent of protests are settled in an informal hearing. If not, the protest goes to a formal hearing with the Appraisal Review Board. Formal hearings can be done by phone, written affidavit, Zoom, or in person. If no resolution is reached at the formal hearing, property owners can then go to binding arbitration or district court.

“We’re very motivated to work with homeowners,” Amezquita said. “Don’t procrastinate. Get it in sooner rather than later.”

The deadline to file your protest is by midnight on Monday, May 16.

Hearings are available in English and Spanish.

Another tip to save money on your property tax is to make sure you have a homestead exemption. It caps the amount your property taxes can increase at 10 percent annually.

Have questions or need help? Contact the Bexar County Appraisal District at cs@bcad.org or 210-224-2432. You can also look at the video library to learn more about the protest process.