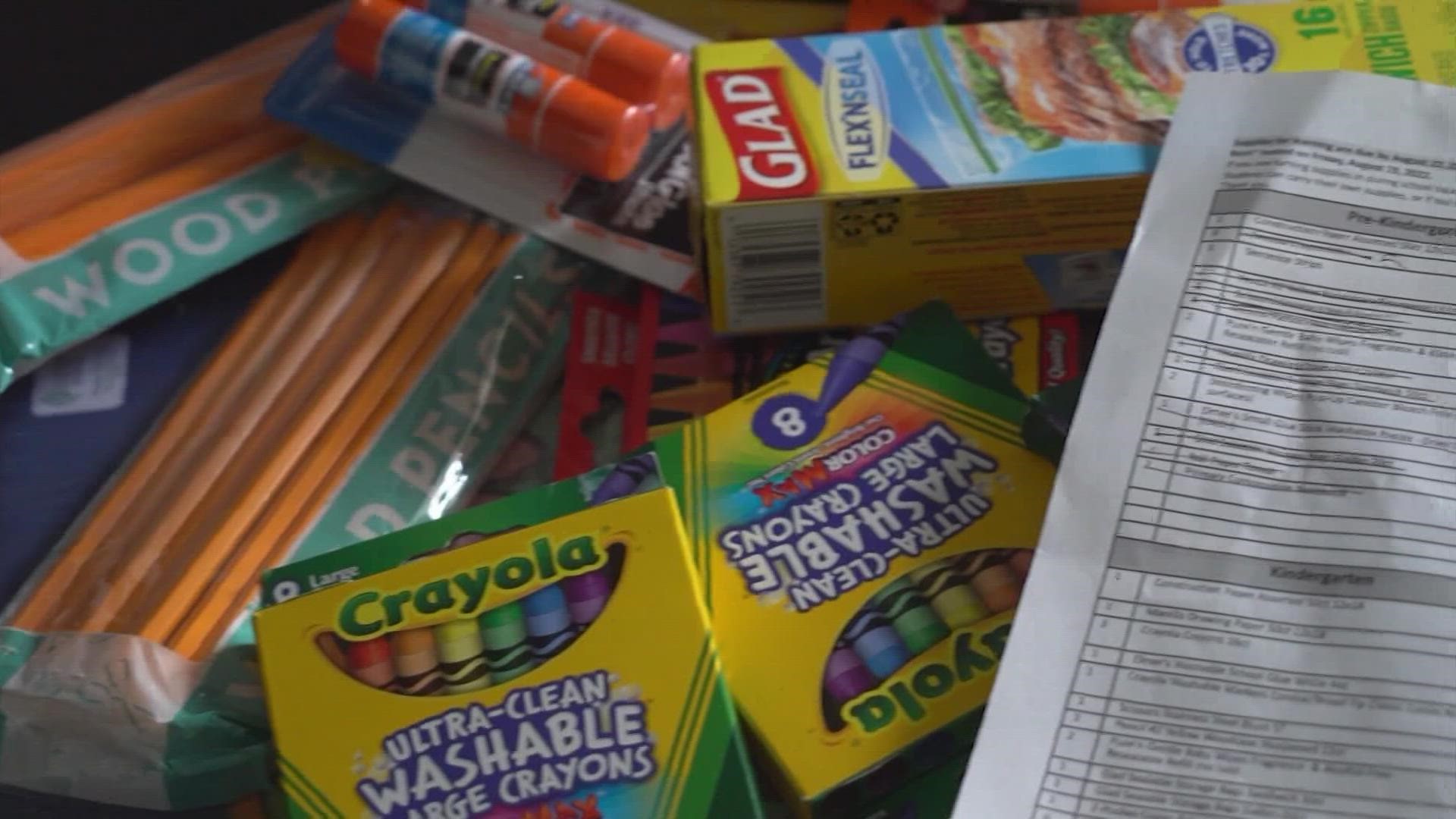

HOUSTON — Parents doing their back-to-school shopping may be in for sticker shock.

It pays to do your homework ahead of time and compare prices for the best bang for your buck. The Passionate Penny Pincher blog is chock full of suggestions and price comparisons.

The best time to shop for supplies across Texas will be the Sales Tax Holiday weekend beginning this Friday through Sunday, Aug. 5-7.

- You won't pay taxes on school supplies or most clothing and footwear that cost up to $100.

- There's no limit on the number of items you can buy and the $99.99 limit is per item -- not per purchase.

- Many stores will have sales that weekend to help save even more money!

In our back-to-school survey, one of the top responses from parents was saving money. So we've put together this tax-free weekend guide to help craft your game plan for this weekend.

BACK-TO-SCHOOL SURVEY: What questions do you have?

School supplies that qualify for Sales Tax Holiday

- Binders

- Blackboard chalk

- Book bags

- Calculators

- Cellophane tape

- Compasses

- Composition books

- Crayons

- Erasers

- Folders – expandable, pocket, plastic and manila

- Glue, paste and paste sticks

- Highlighters

- Index cards

- Index card boxes

- Kits offered by retailers

- Legal pads

- Lunch boxes

- Markers (including dry erase markers)

- Notebooks

- Paper – loose leaf ruled notebook paper, copy paper, graph paper, tracing paper, manila paper, colored paper, poster board, and construction paper

- Pencil boxes and other school supply boxes

- Pencil sharpeners

- Pencils

- Pens

- Protractors

- Rulers

- Scissors

- Writing tablets

RELATED: Mom struggling to afford school supplies: 'It makes it feel like you can’t take care of your child'

Clothing and footwear that qualify for Sales Tax Holiday

- Adult diapers

- Aprons (household)

- Athletic socks

- Baby bibs

- Baby clothes

- Baby diapers (cloth or disposable)

- Backpacks for elementary/secondary students

- Baseball caps

- Baseball jerseys

- Blouses

- Boots: General purpose; fashion; cowboy; hiking

- General purpose/fashion

- Bow ties

- Bowling shirts

- Bras

- Camp clothes

- Caps (baseball, fishing, golf)

- Chef uniforms

- Children’s novelty costumes

- Clerical vestments

- Coats and wraps

- Coveralls

- Diapers (cloth and disposable)

- Dresses

- Earmuffs

- Employee uniforms (unless rented)

- Fishing caps

- Fishing vests (non-flotation)

- Football jerseys

- Gloves: General use; leather

- Golf caps

- Golf dresses

- Golf jackets and windbreakers

- Golf shirts

- Golf skirts

- Graduation caps and gowns

- Gym suits and uniforms

- Hats

- Hooded shirts and hooded sweatshirts

- Hosiery, including support hosiery

- Hunting vests

- Jackets

- Jeans

- Jogging apparel

- Knitted caps or hats

- Leg warmers

- Leotards and tights

- Mask, costume

- Mask, cloth, and disposable fabric face masks

- Neckwear and ties

- Nightgowns and nightshirts

- Painter pants

- Pajamas

- Pants

- Pantyhose

- Raincoats and ponchos

- Rain hats

- Religious clothing

- Robes

- Safety shoes (adaptable for street wear)

- Scarves

- Scout uniforms

- Shawls and wraps

- Shirts

- Shirts (hooded)

- Shoes

- Boat

- Cross trainers

- Dress

- Flip-flops (rubber thongs)

- Jellies

- Running (without cleats)

- Safety (suitable for everyday use)

- Sandals

- Slippers

- Sneakers and tennis

- Tennis

- Walking

- Shorts

- Skirts

- Sleepwear, nightgowns, pajamas

- Slippers

- Slips

- Soccer socks

- Socks

- Suits, slacks, and jackets

- Support hosiery

- Suspenders

- Sweatshirts

- Sweat suits

- Sweaters

- Swimsuits

- Tennis accessories

- Tennis dresses

- Tennis shorts

- Tennis shoes

- Tennis skirts

- Ties (neckties - all)

- Tights

- Trousers

- Underclothes

- Underpants

- Undershirts

- Uniforms (school, work, nurse, waitress, military, postal, police, fire)

- Veils

- Vests (generally)

- Fishing (non-flotation)

- Hunting

- Work clothes

- Work uniforms

- Workout clothes

Items that don't qualify for Sales Tax Holiday

- Items sold for $100 or more

- Clothing subscription boxes

- Specially-designed athletic activity or protective-use clothing or footwear

- For example, golf cleats and football pads are usually worn only when people play golf or football, so they do not qualify for the exemption.

- Tennis shoes, jogging suits and swimsuits, however, can be worn for other than athletic activity and qualify for the exemption.

- Clothing or footwear rentals, alterations (including embroidery) and cleaning services

- Items used to make or repair clothing, such as fabric, thread, yarn, buttons, snaps, hooks and zippers

- Jewelry, handbags, purses, briefcases, luggage, umbrellas, wallets, watches and other accessories

- Barrettes

- Belt buckles (sold separately)

- Bobby pins

- Elastic ponytail holders

- Ribbons

- Hair bows

- Hair clips

- Headbands

- Computers

- Software

- Textbooks

- Certain baggage items: Framed backpacks; luggage; briefcases; athletic, duffle or gym bags; computer bags; purses

- Office supplies under a business account

Online Purchases and Telephone Orders

During the holiday you can buy qualifying items in-store, online, by telephone, mail, custom order or any other means. The sale of the item must take place during the tax-free weekend.