WASHINGTON — UPS drivers will earn an average of $170,000 annually in pay and benefits by the end of the tentative five-year contract deal, UPS CEO Carol Tome said in an earnings call Tuesday.

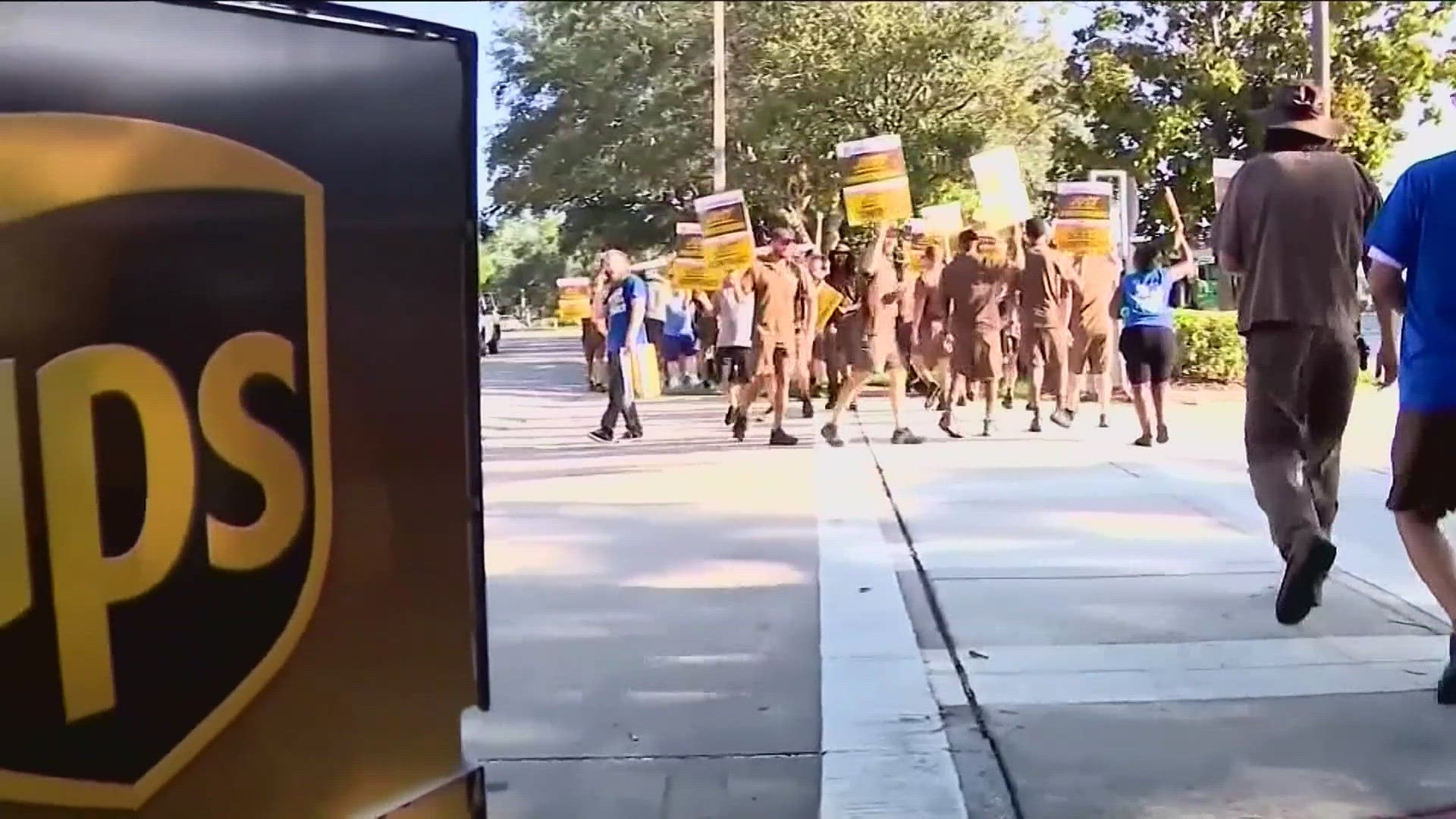

Late last month, UPS reached a tentative deal with the International Brotherhood of Teamsters, potentially averting a strike that threatened to disrupt package deliveries for millions of businesses and households nationwide.

“We expected negotiations with the Teamsters to be late and loud and they were," Tome said. "As the noise level increased throughout the second quarter, we experienced more volume diversion than we anticipated.”

Under the agreement, which still needs to be approved by union members, full- and part-time union workers will get $2.75 more per hour in 2023, and $7.50 more by the end of the five-year contract. The deal also includes a provision to increase starting pay for part-time workers — whom the union says are the most at risk of exploitation — from $16.20 per hour to $21 per hour. The average pay for part-timers had been $20.

"When you look at total compensation, by the end of the new contract, the average UPS full-time driver will make about $170,000 annually in pay and benefits," Tome told investors Tuesday. "And for all part-time union employees that are already working at UPS, by the end of this contract, they will be making at least $25.75 per hour while receiving full health care and pension benefits."

UPS had already tentatively agreed to make Martin Luther King Jr. Day a full holiday and to end forced overtime on drivers’ days off. Tentative agreements on safety issues were also reached, including equipping more trucks with air conditioning.

Voting on the new contract began last week and conclude on Aug. 22.

Revenue fell at UPS in the second quarter and it lowered its full-year revenue expectations by $4 billion as package volumes declined and labor negotiations. Tome said during the company's conference call that union negotiations impacted its package volume the deeper into talks, and the quarter, that they got.

The global shipping industry has been dealing with a package volume decline in part due to unpredictable consumer spending. Spending has been volatile this year after surging nearly 3% in January. Sales tumbled in February and March before recovering in April and May. Rising interest rates are also playing their part, as the Federal Reserve has been aggressively hiking rates since March 2022. Last month the Fed raised its key interest rate for the 11th time in 17 months as part of its ongoing drive to cool the economy and curb inflation.

UPS said that it now foresees 2023 consolidated revenue of about $93 billion. Its prior forecast was for revenue of around $97 billion.