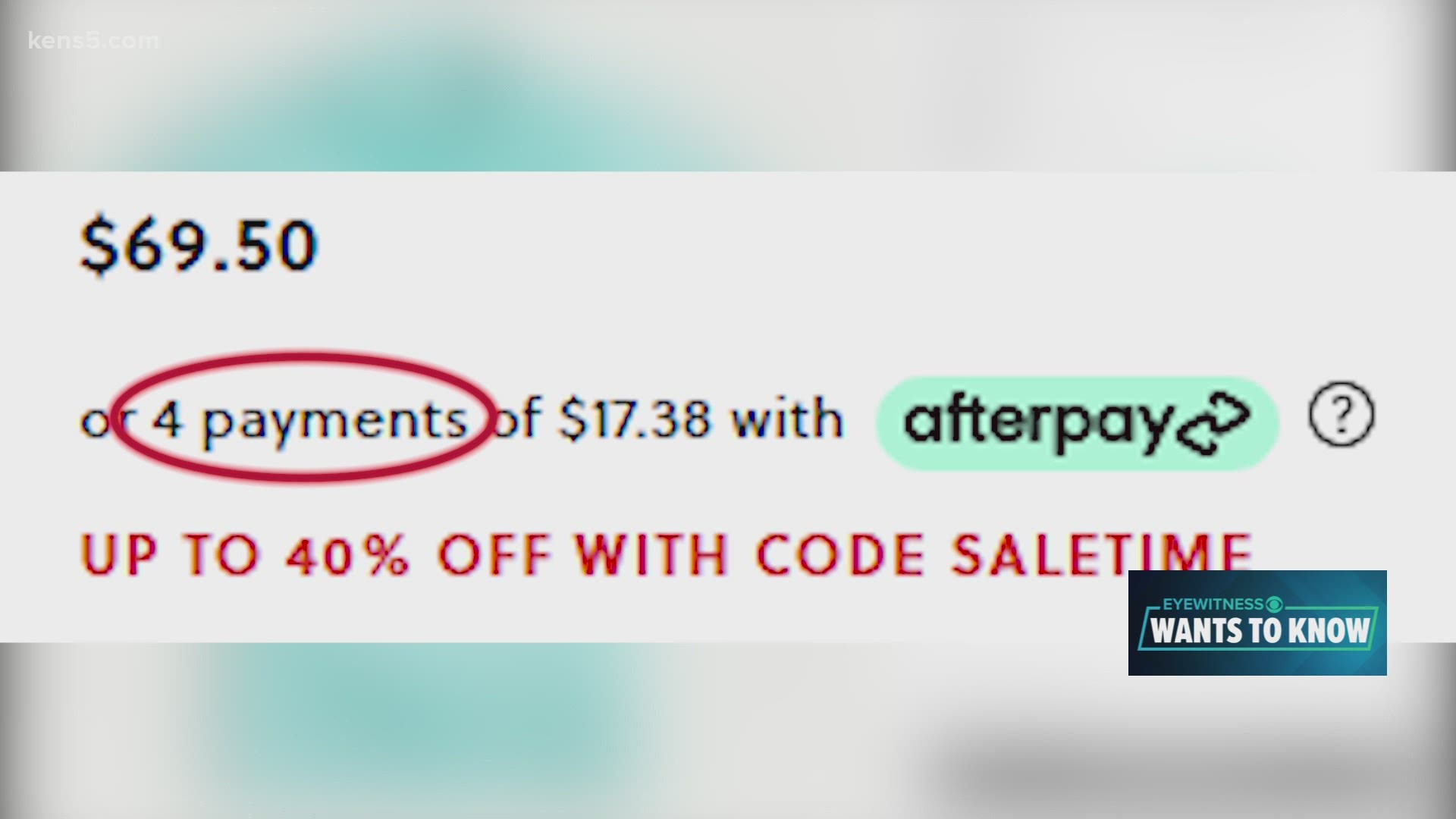

SAN ANTONIO — You have probably seen this while shopping online: A price followed by “or four payments of.” LendingTree.com found about 40 percent of consumers are using what are called buy now, pay later services like Klarna, Afterpay or Affirm. Those services let you make interest free installment payments on a purchase during a several week period.

“These are really about allowing people to finance bigger purchases over a little bit extra time without having to make any interest payments,” said Matt Schulz, a credit card expert at LendingTree.com "If you have a retail credit card or any other credit card, you basically have a month to pay that balance off before you would accrue any interest.”

He described buy now, pay later like having a credit card for a one-time purchase.

“Instead of getting a credit card where you have the allure of that available credit that sticks around after you’ve paid off that initial purchase, these loans are generally finite,” said Schulz. “A lot of people don’t want to deal with credit cards. The ability to make a purchase over a little bit of extra time without having to use a credit card is really enticing to people.”

You do not need good credit to use the service.

“Generally these loans are made to be used either with direct withdrawals from a checking account or with a debit card,” Schulz said.

These services might be good for people in this situation:

“If you know that you’ll be able to pay off that purchase in a couple of months, but you may not be able to pay it off in one month,” Schulz said. “If that’s your situation, then that’s a really good opportunity to use one of these loans. They’re also really good for folks who don’t need a long-term line of credit like you might get from a credit card, but just want a little bit of wiggle room to pay for a bigger purchase.”

Yet, it can affect your credit score.

“It’s super easy to get but it doesn’t usually help you build credit and it can ding your credit,” said Ted Rossman, a senior industry analyst with CreditCards.com.

You can also get charged late fees if you do not pay the purchase off in time. Plus buy now, pay later services can lead to overspending.

“If you stack a bunch of these, it’s a lot to keep track of,” Rossman said. “It makes it sound more affordable. I think there is an inherent danger in buying something now and planning to pay it off later. Maybe you don’t have the money now, but you think you will in six weeks. That could be a slippery slope. You lose your job, something happens.”

Each service has different terms and conditions, so see what they are before you sign up.

“Just because you know one doesn’t mean you know the other,” Schulz said. “It’s really important to follow the rules, understand what the fees are, what the payment schedule is, and any other kind of details and nuances you might need because what you don’t know can come back to hurt you.”

Most buy now, pay later services are offered at the point of sale when you buy online. You also can get an app for some services. It gives you a digital card number that lets you make purchases both online and in store.

If you have a question for Eyewitness Wants To Know, email us at EWTK@kens5.com or call us as 210-377-8647.